|

| Neither solar power, nor wind power will solve Europe's energy problems. |

Another reminder of the blessings of the American led shale gas revolution:

As the world moves towards alternate energy sources, despite all the optimism of sun and wind energy, the real revolution in the energy world has been driven by conventional fossil fuels. Shale gas now dominates the global energy scenario.

US shale production has leaped to over 13 billion cubic feet/day - about 30% of the country’s natural-gas supply, heading toward 50% in the next few years. This increased production has been the primary driver for renewed profitability and growth in several North American industry sectors. Armed with massive and lasting advantage in energy costs over global rivals, companies are now considering major capacity additions in the United States for the first time in decades. America produced over 80% of its total energy needs in H1-2012, the highest since 1991. As per the US Energy Department, the country, poised to produce 11.4 mln bpd of oil, biofuels and liquid hydrocarbons next year, could parallel Saudi Arabia’s production. USA looks poised to approach energy independence before end of this decade. US ethane supplies are forecast to double by 2016, compared with the levels seen before the shale boom, to over 1.4 mln bpd. As a result, the US ethylene industry has seen a revival and restart of idled units, amid significant capacity expansions by either debottlenecking or new world-scale crackers. Royal Dutch Shell is planning an ethane plant in Beaver County. Dow Chemical is shutting operations in Belgium, Holland, Spain, the UK, and Japan, and investing into a propylene venture in Texas using cheap natural gas as feedstock. A study by the American Chemistry Council said the shale gas bonanza has reversed the fortunes of the chemical, plastics, aluminium, iron and steel, rubber, coated metals and glass industries. This is accompanied by the return of manufacturing clusters of machinery, electrical products, transport equipment, among others, from China to the US triggered by a 16% annual rise in Chinese wages over the last decade

The shale gas revolution is - and will continue to be - the main driver for economic growth and prosperity in the United States. Crisis-ridden Western Europe could also hugely benefit from unconventional gas, but the that seems unlikely - at least in the near future - as the global warming enviro-fundamentalists are dictating policy in countries like Germany and France:

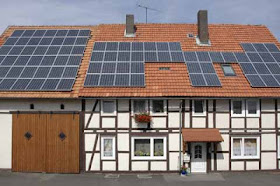

According to the estimates of the US Energy Information Administration, Europe has around 639 trillion cubic ft of recoverable shale gas resources, around 75% of USA’s reserves. However, as USA marches ahead with shale gas development, Europe is headed in the opposite direction. Europe is at the core of attention of the geopolitical debates surrounding shale gas. The shale revolution might weaken Russia's authority of the continent, as Europe would become less dependent on gas imports from Russia. In Europe, natural gas prices are dictated by Russia’s Gazprom, as Germany imports 36% of its gas from Russia, Poland imports 48%, Hungary- 60%, Slovakia imports 98% and the Baltics import 100%. Another challenge will be loosening Russia's grip over supplies. Moscow controls the region's pipelines. Many buyers in Eastern Europe are also locked into supply contracts of as long as 25 years with Russian gas giant OAO Gazprom—making it uneconomical in some cases to seek a new supplier. Currently, US natural gas pricesare about 35% of European levels, making it almost impossible to match US’ production costs. U.S. wholesale natural gas prices currently cost around $3.5 per million British thermal units (mmBtu), compared with $9 per mmBtu in Europe. The almost total failure of Europe’s leaders to face up to the reality of shale gas development, or to prepare for their energy crunch ahead is surprising. Germany is slated to shut down its nuclear plants by 2022, is opting instead for a politically-correct grid. The goal is to raise the share of renewables from 20% to 35% by 2020 at a cost of €200 bln, and march towards renewable dominance by mid-decade at an investment of another €600 bln. German industries are concerned about losing a competitive edge against U.S. rivals where the shale gas boom has led to a sharp drop in industrial energy costs. German energy costs, by contrast, are rising as its government has decided to exit nuclear power generation, invest billions of euros into expanding the renewable generation sector and largely relying on imports to meet its natural gas demand. France has shale but has imposed a drilling moratorium and will also shut down a nuclear plant for good to appease the Greens. In much of Western Europe the situation remains unclear: France, estimated to have the second largest reserves within Europe (around 180 trillion cubic ft) imposed an outright ban on fracking under the previous government, and seems unlikely to change its stance under Francois Hollande. Italy has banned nuclear power, while Britain is faced with issue of closing eight coal plants by 2015 to keep up with EU carbon allowances; as well as an ageing nuclear industry that is not being replenished by new commissions.

Read the entire article here

No comments:

Post a Comment